details:

rank means company market cap, e.g. https://companiesmarketcap.com/

fired 20% means there exists a time period where T => T2 with a gap <=6 months, and during which he company either shrunk by >=20%, or didn't (due to also hiring people) but where it's reasonable to believe that that many staff did leave for any reason, voluntary of forced or sold/broken up/etc to another company. Fires is shorthand for leaving for any reason excluding death or some kind of catastrphe (that's because changes like that are essentially random, and wouldn't have the supposed beneficial effect of cutting the fat)

We will know this by looking at papers like sf gate, la times, wash post.

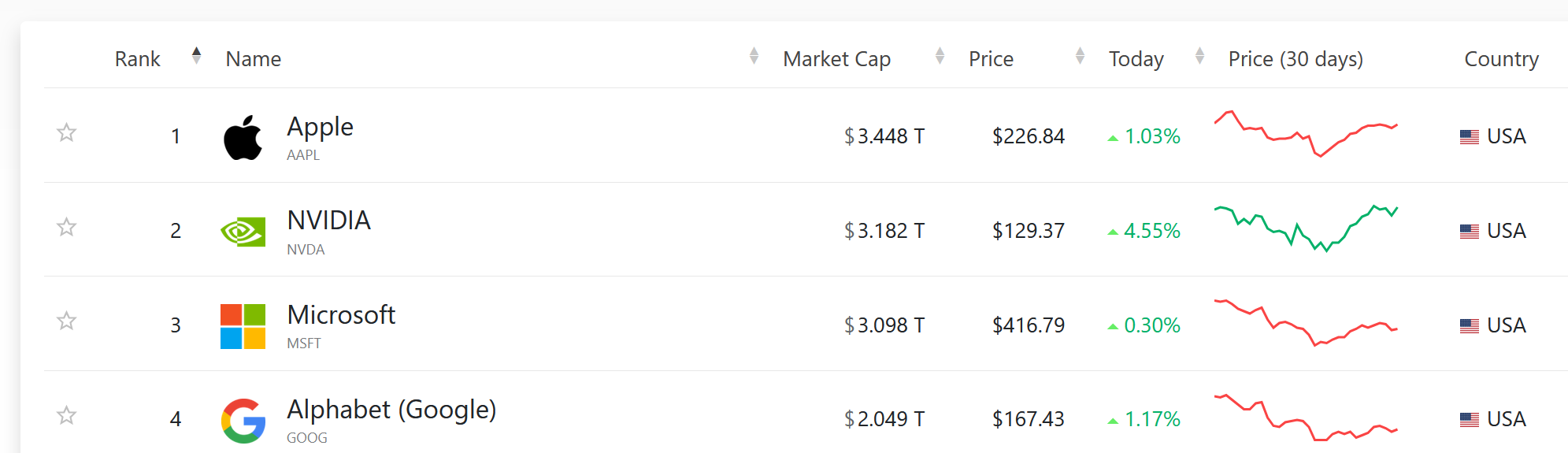

as of claim creation they are 4th ranked, 2.089T valuation.

Claim judged at end of time period, june 30 2029

This is a new type of claim that tries to be a double conditional, based on a crux. The crux is: google must take dramatic action to cut headcount if it wants to retain top10 standing. So, YES if: it cuts people and retains position, or it doesn't cut and loses.

Claim judged at end of time period, or earlier if google is totally gone as a company. Even if google cuts early, and even if google falls out of the top10 early, the claim will be judged at end. Unless google is destroyed. If broken up, google-ness goes in priority order to: the company with the closest sounding name (if any), the group with the most prior staff

@Quroe Yes. I'd like there to be an easier way to say this cause I find it useful. Maybe something with "iff"?

@Ernie The only real difference between this NXOR market and XOR would be an inversion between what world resolves to YES or to NO. I've been dabbling in trying XOR out, and I have found that it makes making the title more compact, but only if the targeted events are similar enough to make it make grammatical sense. Here are two of them:

@Quroe yeah, totally! It kind of matches people who say things like "the only way to achieve goal X is to adopt policy P", you get to bet on outcomes whether or not they manage to actually do P.