See https://www.nytimes.com/2025/05/06/us/politics/trump-very-big-announcement.html

Unless otherwise implied, a topic here only applies to the announcement itself, and not related future policy. Multiple topics can resolve YES at the same time. Some topics are supersets of others, e.g. "Foreign Policy" and "Tariffs."

An invasion of a foreign nation would resolve "Foreign Policy" and "Military" YES. It would also resolve "Tariffs" YES if that invasion caused new tariffs announced at the same time as the invasion.

If by May 20 Trump makes no announcement that is unambiguously the one he referred to on May 6, market settles YES to "Trump makes no announcement by May 20" and NO to everything dependent on him actually making an announcement. (Announcement doesn't need to be made by Trump himself, just by the administration.)

Another nation joining the Abraham Accords would settle "Gaza/Israel conflict" to YES.

Update 2025-05-07 (PST) (AI summary of creator comment): The creator has clarified the resolution criteria for the Gaza/Israel conflict topic:

Any announcement directly involving Israel will cause this topic to resolve to YES.

This includes any announcements concerning the Abraham Accords.

This applies even if the announcement is not directly about the current conflict.

Update 2025-05-07 (PST) (AI summary of creator comment): Further clarification on the Gaza/Israel conflict topic, specifically regarding announcements concerning Iran:

An announcement that is primarily policy on Iran will resolve this topic to NO if it does not include substantial mention of Israel.

If an announcement concerning Iran includes substantial mention of Israel, it will be considered directly related to Israel and resolve this topic to YES (in line with the 2025-05-07 update stating that any announcement directly involving Israel resolves this topic to YES).

The resolution will be determined based on the announcement itself, not the magnitude of any indirect effects the policy might have on Israel.

Update 2025-05-07 (PST) (AI summary of creator comment): The creator has clarified the relationship between Tariffs and Tax Reform (or a general 'Taxes' topic):

Announcements regarding Tariffs will also be considered relevant for the Tax Reform topic (or a general 'Taxes' topic).

This is because, as confirmed by the creator, the market's rules define taxes to include tariffs.

Update 2025-05-09 (PST) (AI summary of creator comment): The creator has stated their planned process for resolving the market:

Once the creator is confident in identifying the specific announcement referred to in the market question, they will proceed with the following steps.

A draft resolution will be written.

This draft will then be shared to request for comment before the market is finally resolved.

Update 2025-05-11 (PST) (AI summary of creator comment): The creator has clarified the resolution criteria for the US economy topic:

This topic will resolve to YES if the announcement involves anything that has a significant impact on the US economy.

This interpretation was proposed by user @Odoacre in response to the creator's request for clarification, and the creator agreed to it.

An example discussed and accepted was that an announcement concerning medical costs would qualify if it is deemed to have a significant impact on inflation, thereby impacting the US economy.

I don't buy that the big announcement is just about prescription drug prices. Something like this seems more likely: Report: Saudis will try to get Trump to back deal for Palestinian state, end to war, regional normalization | The Times of Israel

I made a separate market to focus on whether that deal happens: [Short fuse] Will Trump announce that the US will recognize Palestine as a state by the end of this week? | Manifold

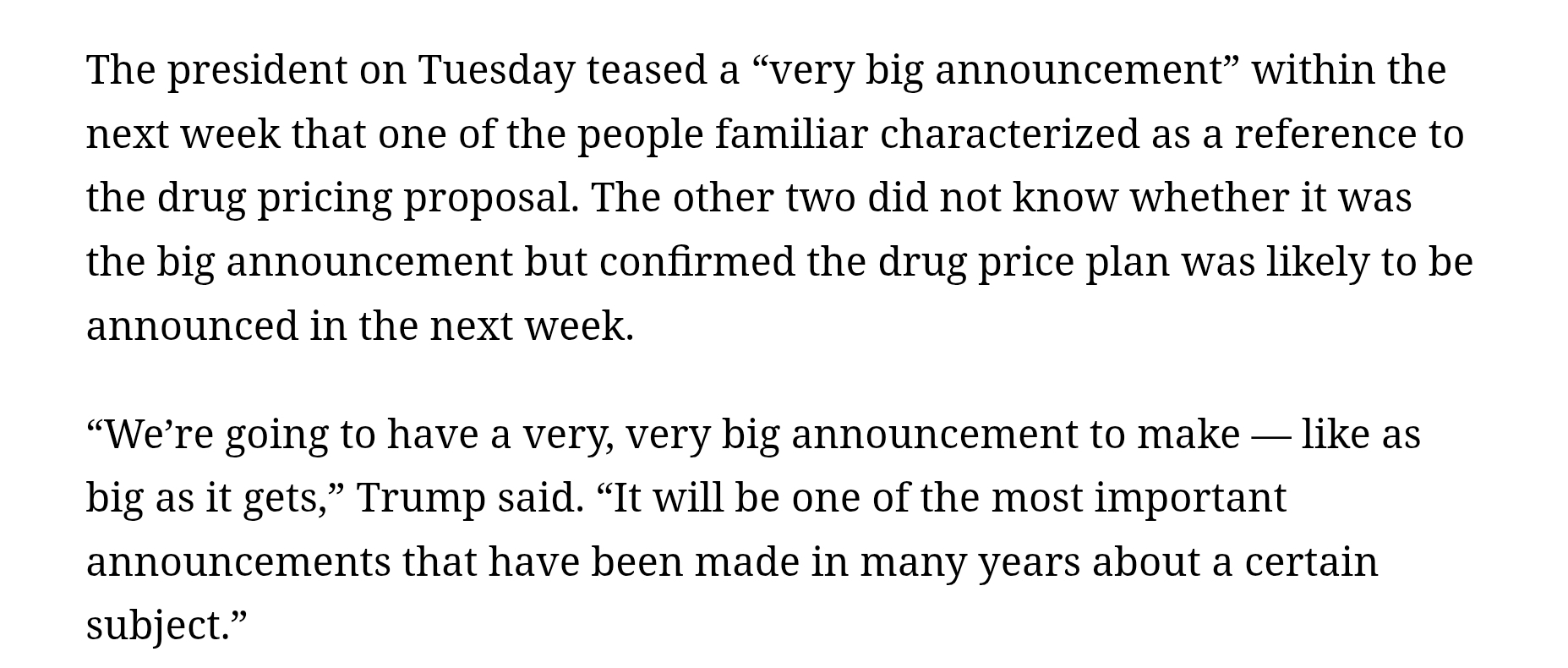

@TimothyJohnson5c16 What more do you need than Trump saying "my next truth will be one of my most important and impactful" and following it up with a truth about drug prices which includes "I will be signing one of the most consequential Executive Orders in our Country's history?

@ChristopherRandles Trump's philosophy is to never communicate clearly when he can instead keep his options open through ambiguity.

So if nothing comes out of his Middle East trip, then the drug price order will be "the" announcement. But if he gets some sort of Middle East peace deal, then it will be that instead.

@copiumarc Maybe people see it as drug prices but there is a vaguely related tariff wall on drug also coming such that tariffs are vaguely connected but it is not really about taxes? Maybe there is no chance of the taxes resolving yes but some uncertainty about the tariff connection?

@Joshua You seemed first to move on pushing the Medicare option as high as it got, and you also defended your targeted percentage with conviction.

You have my attention.

I'd love to tap into whatever news source you were listening to then, assuming that we actually resolve it and/or the other drug market option YES.

@Odoacre Ok it's very unclear to me how to resolve this one. There are basically two interpretations:

1) Anything that relates to the US domestic economy in any substantial fashion. I.e. everything that isn't foreign policy.

2) Something that intends to make a broad impact on the economy, or is labeled as attempting to improve the economy - like any big spending cuts or increases aimed at improving US economy, interest rate changes, tax reform, or financial regulation/deregulation.

I think #2 is the intention but I'd like to clarify with you. In particular, how would this resolve for the new Medicare drug price plan announcement?

@NicholasCharette73b6 i was thinking anything that has a significant impact on the us economy. In this particular example, I would expect medical costs to have a significant impact on inflation, so I would count this as yes (which is why I bought it up)

@AlexanderTheGreater I haven't looked yet, so it might be easy to find, but a response to this with a link would be very helpful for starting to resolve this market.

@ChristopherRandles https://nitter.net/america/status/1921693853062492302

Also: yay, price controls! A true staple of Republican politics!

Edit: "The United States States of America" - the president in what he claims to be an incredibly important announcement

@AlexanderTheGreater Trump speed running making free market libertarians out of every last Democrat

If we believe that there are reasons for higher prices in USA (like higher salaries, propensity for litigation esp re medical malpractice and so on) what do we expect the effects of this executive order will be?

Higher drug prices in the rest of the world?

Lower usage of drugs in rest of world due to higher prices?

Pharmaceutical stock price collapse?

Pharmaceutical company withdraw from sales to USA due to costs, in order to continue sales in rest of world at current prices? (probably unlikely?)

Or maybe not much as Pharmaceutical companies will challenge it like an existential issue and will be expected to win or at least keep challenging it until after Trump out of power?

@ChristopherRandles I'd in the very least expect drug availability to drop a little bit. If there is any shortage globally, the US will be more likely to be along the countries impacted by it.

@AlexanderTheGreater

Not sure about that. There is likely large contributions towards development costs. This can probably falls quite a bit before it is not making a contribution to development cost so a case of some contribution is better than none so availability continues. (This is why I put the probably unlikely? to withdraw from sales to USA.) Also if prices go up in rest of world so less demanded, then there is going to be sufficient available unless production is cut excessively in response. I not sure I see why excessive production cuts should be expected, perhaps as a negotiating tactic to make shortages a consequence so as to make Trump back down?

Still perhaps deals stall while waiting for clarity and this delays drugs being sent to where they are needed is also still a possibility.