Resolves according to the budget speech itself, items will not resolve based on leaks or on information released post-budget, except in the case of a question which is difficult to resolve based on the speech which is clarified in supplementary announcements.

“Any increase in…” questions will resolve on any change that directly increases a tax rate, or changes to e.g. bands or eligibility. May resolve 50% if a change results in some taxpayers paying more and some paying less.

Update 2025-08-06 (PST) (AI summary of creator comment): The "Increase in VAT rate" option refers specifically to changes in the VAT rate itself, not to extending the scope of VAT to previously exempt goods.

@Noit https://www.bloomberg.com/news/articles/2025-11-03/reeves-targets-uk-rich-with-exit-and-mansion-taxes-among-options

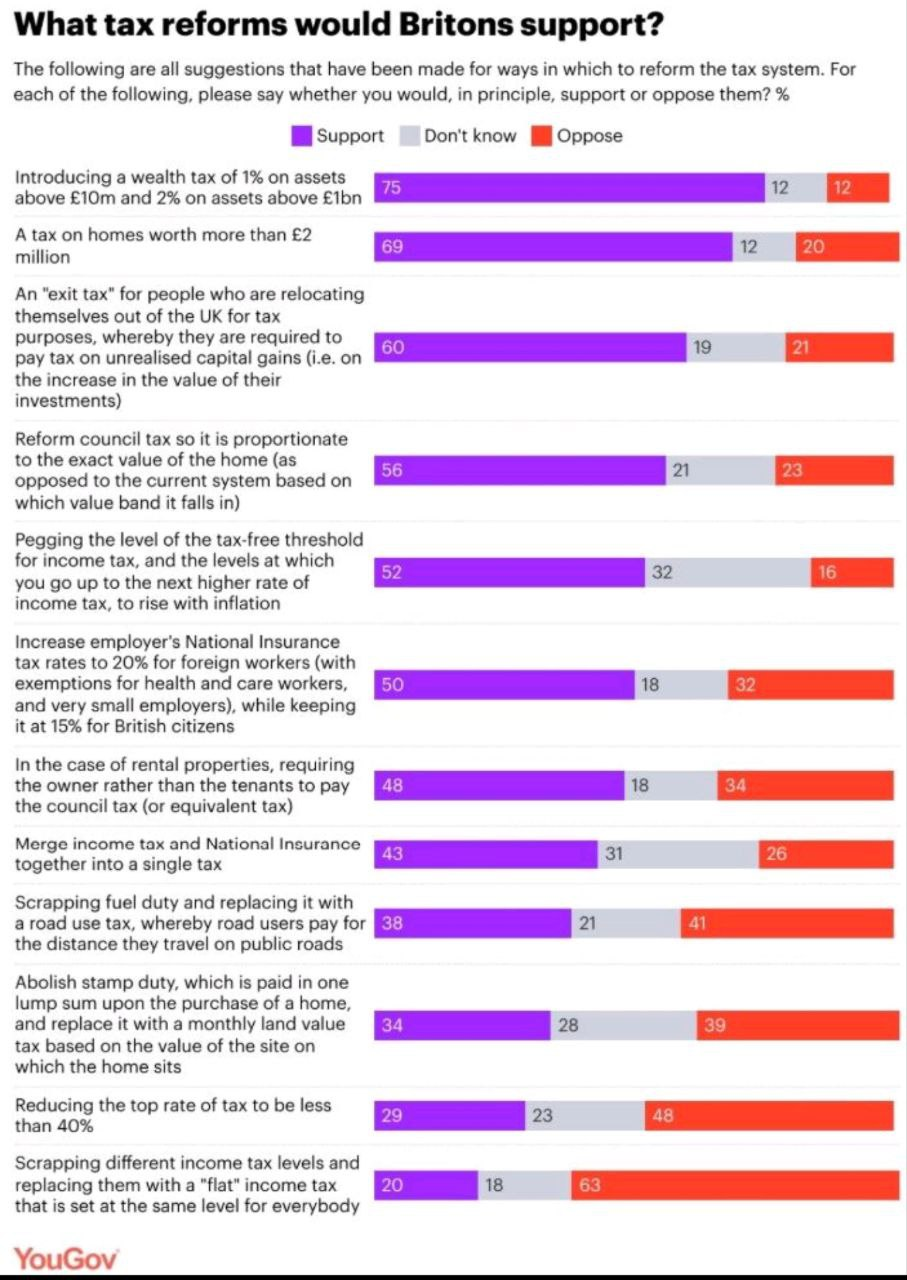

"Several newspapers have reported that Reeves is looking at reforming council tax to raise more revenue from Britain’s more expensive properties. That has led to suggestions that she is effectively considering a tax on mansions, a policy that has been popular with Labour members of parliament in the past."

@Noit could easily see this going either way. On the one hand, they need revenue from somewhere and it's a tax they've not promised not to raise, but on the other hand it doesn't raise much and it tends to upset people

@Noit can I clarify: would extending the scope of VAT resolve this YES? E.g. if some good that currently has 0% VAT was given the standard 20%, is that an "increase in VAT"? Or is it only if the standard rate is increased from 20%?

Might improve clarity to mention it's the UK budget in the title in addition to just in the tags, since the site is mostly non-brits