The next round of house-made sports markets we make (for the length of the experiment) will not allow bot taker orders on them.

I will run a poll in a month and ask users (ideally only for those who've traded on the sports markets) whether they like markets without bots placing taker orders (orders that fill against the AMM or other users' limit orders) on them better or worse. The bots can still place maker orders, (bets that don't fill immediately) on those markets.

E.g.:

Update 2025-11-01 (PST) (AI summary of creator comment): Clarification on Bot Definitions:

Only orders filed through the API that fill against the AMM or other maker orders are considered bots.

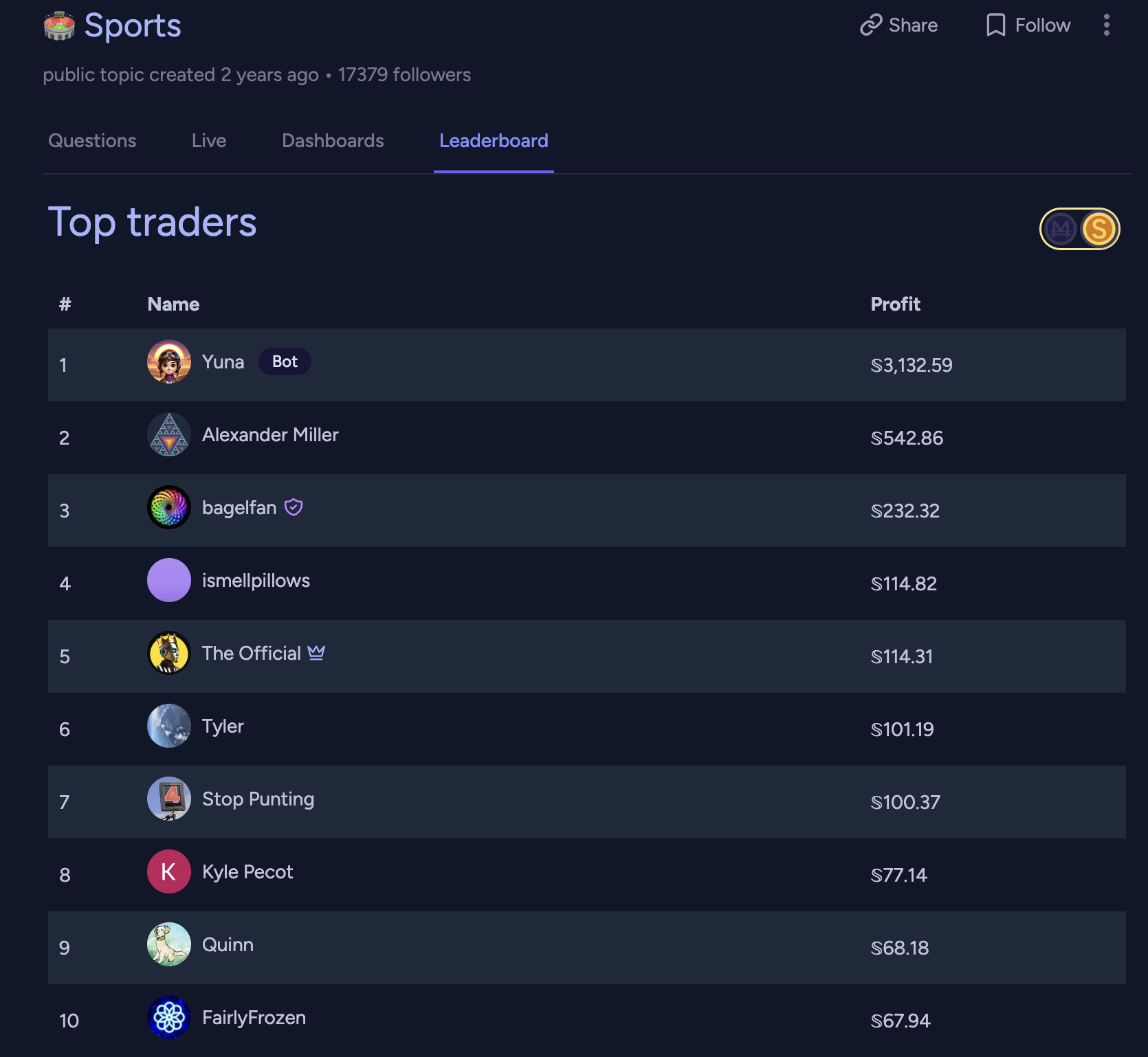

@ian This answer seems to me as obvious: without bots, the markets will be more inefficient, meaning that there are more profit opportunities for humans. If people profit more, they will like the markets better.

I don't really get the 'adding liquidity' argument, market taking orders is not adding liquidity and does not benefit other users, what other people might like is market making orders.

No, people do not enjoy getting continuously sniped by a bot

I will run a poll in a month and ask users whether they like markets without bots placing taker orders (orders that fill against the AMM or other users' limit orders) on them better or worse.

how aware will users be of which markets they've traded in do/don't allow this? seems like for most casual users it wouldn't be particularly visible? (i assume the main result will be actual metrics about activity in the markets themselves, not user perception, but seems like a tough area for users to self-evaluate)

@Ziddletwix I guess I was thinking that it would be obvious to users trading on the markets bc there will be more profit opportunities. Adding a banner to those markets seems kind of like fishing for compliments tho

@Ziddletwix maybe the right question is will positive profit be distributed amongst more unique users. I think SG would say that some human will do the bot's job but I think they won't do as good a job as often, and this will leave profit around for more users.

@ian i think it depends on the underlying goal here? assuming it's just general "user satisfaction", can't really directly test that via market randomization so you need to pick a proxy metric. IMO I'd probably look at # unique traders, maybe supplemented by # trades/trading volume/"unique users with a profit" (although imo that's farthest from "user satisfaction") to see what else turns up.

but that's just for evaluating the test from manifold's perspective, if this market is directly about "will users like them better" then I don't think those proxy metrics really fit the spirit of the question, and i'd probably just do a poll (even tho that'll just test "do users like the change" they won't be very perceptive about the actual market-to-market differences) or N/A if instead it'd be better to make this market about "will # unique traders increase" or etc (which would also be interesting).