Resolves YES if Sokolowski v. Digital Currency Group, Inc., 4:25-cv-00001, (M.D. Penn.) survives defendants' motion to dismiss (e.g., 12(b)(6) or a bankruptcy related motion), In the event that such a motion is granted in part, I will resolve to a % based off of the number of defendants and claims remaining (e.g., a MTD which results in the dismissal of 2 of 3 parties will result in a 33% resolution).

Resolves NO if a motion is granted in full; or plaintiffs dismiss the suit with or without prejudice prior to the last deadline for defendants to file such a motion.

The docket can be found here (or on PACER here). A copy of the original complaint can be found here.

The MTD by defendants Silbert and DCG (ECF 16) is available here. (Mooted by amended complaint but should represent closely the pending brief on renewed MTD)

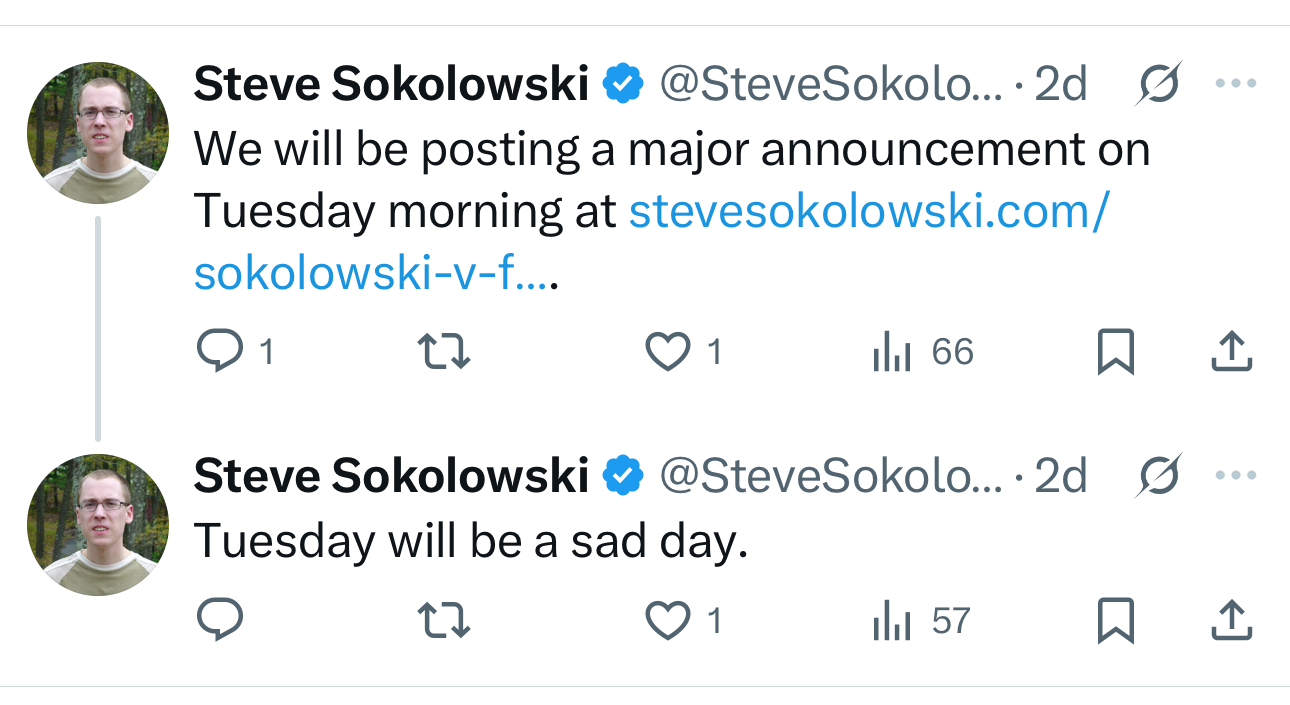

I think the news will be the fraudsters won because he’s thrown in the towel to exploit the growing AI Halloween music market that all today’s kids can’t get enough of.

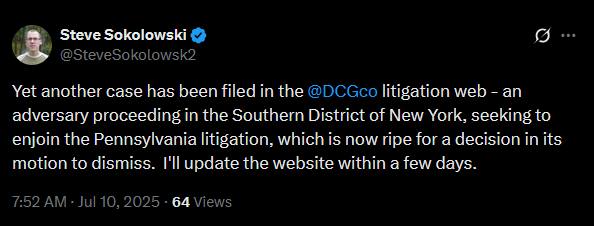

@kopecs Gave it another go while I had some downtime: looks like it is 25-01111-shl Digital Currency Group, Inc. v. Vincent Falco et al

@kopecs @FrederickNorris He was also sued in state court by Wells Fargo for his unpaid $19,000 credit card bill about a week ago: https://civil.centrecountypa.gov/courts.civil.portal/Attachments/GetAttachmentById?id=1024204&caseID=204691

@kopecs It will be somewhere on there, not as easy to find. You'll have to wade through a lot of docket entries.

@KevinBlaw Hmm, turns out bragging about netting $.75M in BTC profit, having an interest in a paid off house, and bragging about it all over the internet isn't a great way to get a creditor to ignore what you owe them! (Neither is suing them for some frivolous BS either, I guess.)

@kopecs I can’t make heads or tails of this but I also don’t want to sink my life into it. Seems like they are saying the bankruptcy process is the only proper venue and that Soko isn’t even the right party to pursue this.

@KevinBlaw The adversarial proceeding is basically (1) only the debtors (in a collective sense) are allowed to sue us; (2) Steve, and this other guy Falco, are trying to sue individually; (3) this is incompatible w/ the bankruptcy since they're just trying to end-run around a fair division to creditors.

So different sort of "wrong party to sue us" argument. More so "get in line with everybody else" (with the caveat that at least Steve can't, since he sold his ticket in line already)

@kopecs if AI can get its head around the bankruptcy code enough to make a coherent response, I will be impressed.

I see in the docket in the case at hand, that the Defendants have put the court on notice of the bankruptcy proceedings. I expect that there is going to be a stay issued in the district court and that the motion to dismiss may never be decided. I guess that would warrant an N/A resolution?

Funny to imagine the Soko brothers driving to the southern district of New York to file their latest missive. The cost in tolls and parking alone makes me chuckle.

If you're suing individually over losses incurred through a company (CM LLC), that’s a major risk to your case.

.

.

.

In other words, you're taking an uphill path. It’s not hopeless — but it’s far from a slam dunk.

When I run it through my AI, it says the case is gonna get dismissed. But, I haven't spent 410 hours on it. Just 4 minutes.

@KevinBlaw "The characteristics of the service Genesis provided become stark with the following statement: Had Plaintiffs merely wished to make loans, they could have sought direct counterparty relationships and undertaken the associated duediligence burden, accepting concentrated counterparty risk." = I would sanction this sentence.

@KevinBlaw defendants are equitably stopped from raising defenses. I stopped reading for the morning when I got to that whopper. It reads like the scribbling of an insane person that are purified through chatGPT

@KevinBlaw This is much worse than I thought it would be. It is difficult for me to believe that anyone could look at this and think it's good.

AI absolutely rekt.

Per Steve's twitter response should be on the docket circa 11:30pm. I'll pull it for courtlistener around then.

@kopecs Holy hell he attached 170 pages of unpublished opinions to it.

(In case anyone needed convincing that LexisNexis MCP would be a bad idea)